doordash business address for taxes

It may take 2-3 weeks for your tax documents to arrive by mail. EIN for organizations is sometimes also referred to as.

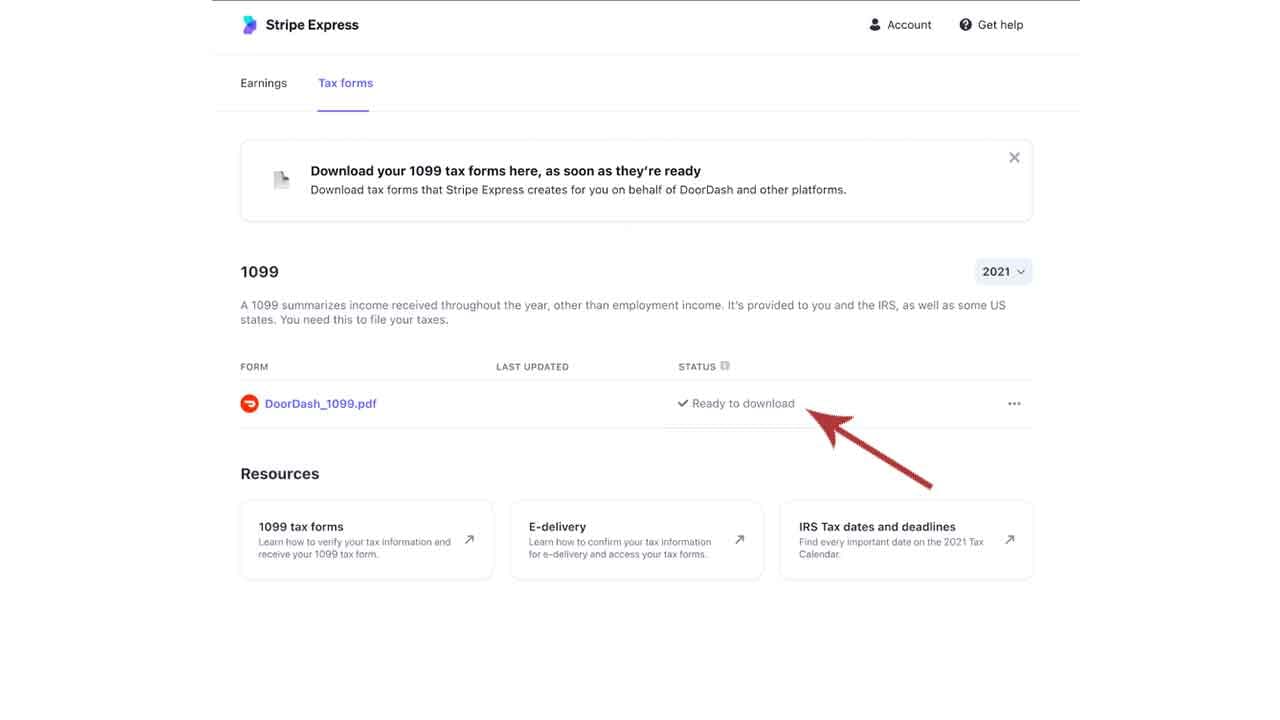

How To Get Doordash Tax 1099 Forms Youtube

Please contact the moderators of this subreddit if you have any questions or concerns.

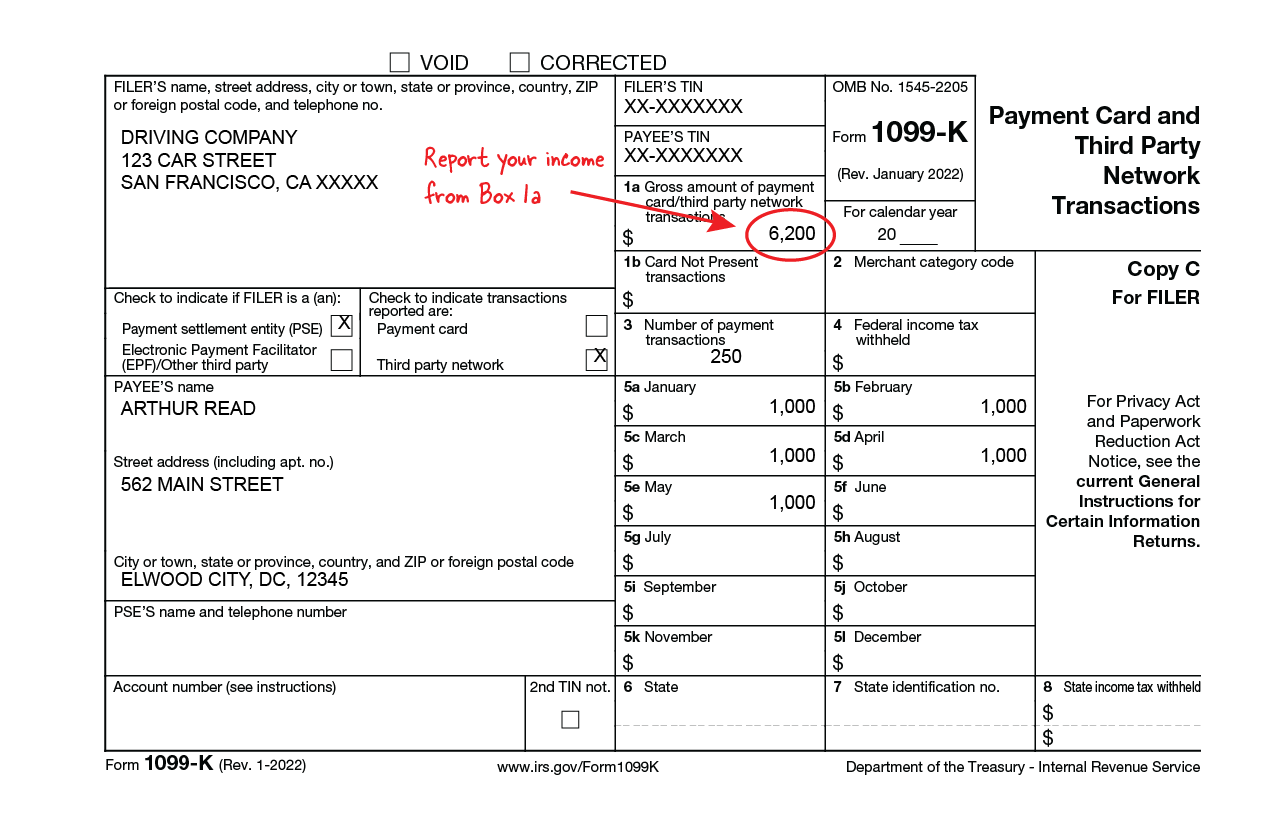

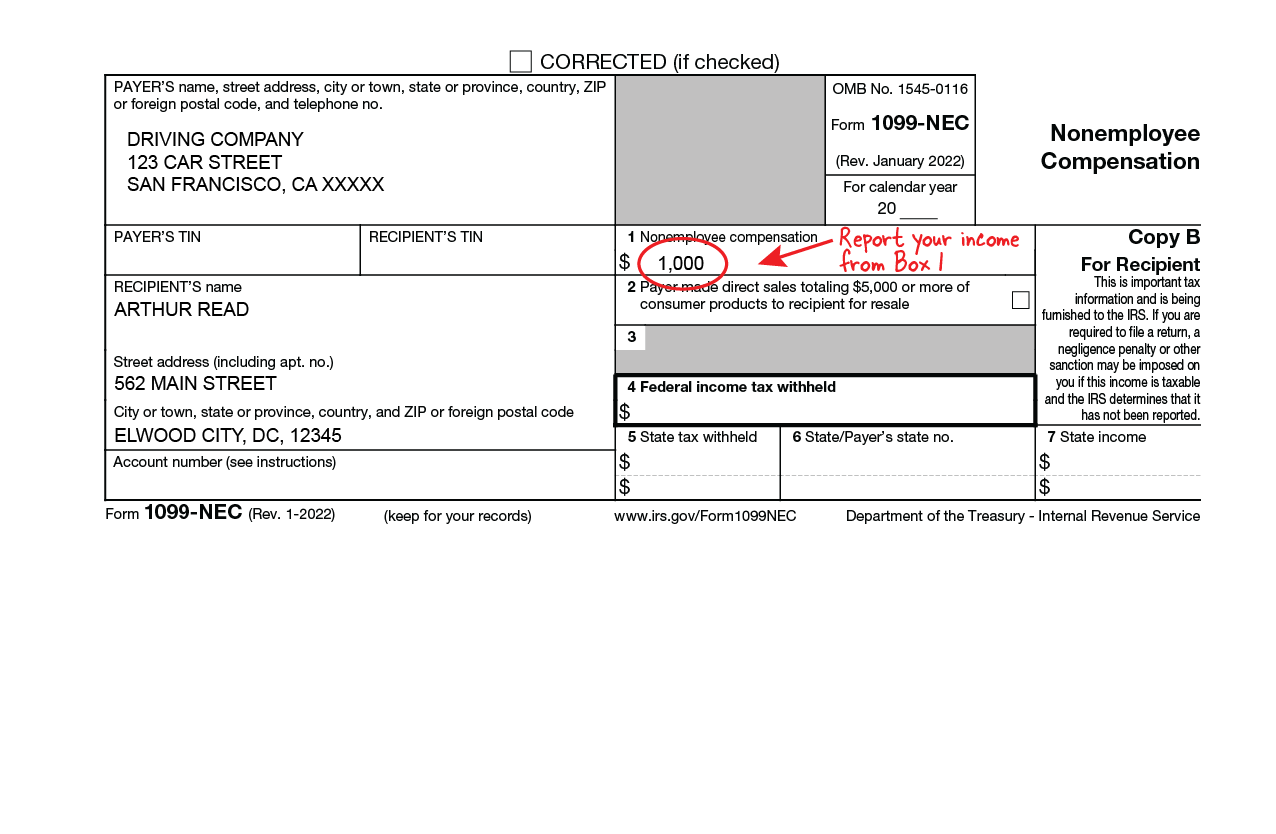

. Dashers will not have their income withheld by the. A 1099 form differs from a W-2 which is the standard form issued to. Choose the expanded view of the tax year and scroll to find Download Print Form just above the Close button.

The forms are filed with the US. Is a corporation in San Francisco California. - All tax documents are mailed on or before January 31 to the business address on file with DoorDash.

If 100 of the use is business you can. It should be included in the 1099 info that Doordash sends you. All tax documents are mailed on or before January 31 to the business address on file with DoorDash.

As a Dasher you are considered a. Does DoorDash send you. BUSINESS ADDRESS EIN 462852392 An Employer Identification Number EIN is also known as a Federal Tax Identification Number and is used to identify a business entity.

Grow your sales and increase business margins with DoorDash. Paper Copy through Mail. Your biggest benefit will be the.

The self-employment tax is your Medicare and Social Security tax which totals 1530. The employer identification number EIN for Doordash Inc. Your FICA taxes cover Social Security and Medicare taxes 62 for Social Security and 145 for Medicare.

A 1099-NEC form summarizes Dashers earnings as independent. If you dont consent to e-delivery by January 6. It doesnt apply only to.

Keep your restaurant taxes organized. How Do Taxes Work with DoorDash. Internal Revenue Service IRS and if required state tax departments.

You will pay to the Federal IRS and to the State separate taxes. Ad Talk to a 1-800Accountant Small Business. DoorDash will file your 1099 tax form with the IRS and relevant state tax authorities.

This is the reported income a Dasher will use to file their taxes and what is used to file DoorDash taxes. Yes - Just like everyone else youll need to pay taxes. DoorDash dashers will need a few tax forms to complete their taxes.

If you earned more than 600 while working for DoorDash you are required to pay taxes. Tap or click to download the 1099 form. Schedule C Form 1040 is a form that one must fill as part of their annual tax return when they are sole proprietors of a business.

Paper Copy through Mail. Please allow up to 10 business days for mail delivery. List on the DoorDash app or build your own online ordering system for delivery and pickup.

- All tax documents are mailed on or before January 31 to the business address on file with DoorDash. This means you will be responsible for paying your estimated taxes on your own quarterly. If 30 of the use of your phone is related to your deliveries you can claim 30 of your phone service bill and 30 of the equipment cost.

This Is A First What Do You Do When A Business Refuses To Provide You With A Tax Invoice Doordash Customer Support Chat R Ausfinance

Do 1099 Delivery Drivers Need To Pay Quarterly Taxes Entrecourier

Doordash Taxes Does Doordash Take Out Taxes How They Work

Doordash Taxes Made Easy Ultimate Dasher S Guide Ageras

Doordash Taxes Made Easy Ultimate Dasher S Guide Ageras

Guide To 1099 Tax Forms For Doordash Dashers And Merchants Stripe Help Support

Doordash Taxes Schedule C Faqs For Dashers Courier Hacker

Doordash 1099 Taxes Your Guide To Forms Write Offs And More

The Delivery Driver S Tax Information Series The Information Contained In This Information Series Is For Educationa In 2022 Doordash Business Tax Mileage Tracking App

How Do Food Delivery Couriers Pay Taxes Get It Back

How To Do Taxes For Doordash Drivers 2020 Youtube

How Do Food Delivery Couriers Pay Taxes Get It Back

Guide To 1099 Tax Forms For Doordash Dashers And Merchants Stripe Help Support

Doordash 1099 Taxes Your Guide To Forms Write Offs And More

Doordash 1099 How To Get Your Tax Form And When It S Sent

Doordash 1099 How To Get Your Tax Form And When It S Sent